What Is Working Capital — And Why Managing It Matters

I sometimes hear people say:

“Having negative working capital is great — it means my operations are lean and I leverage my vendors!” or,

“Positive working capital is great because it shows I have a healthy balance sheet.”

So, which is right?

Well, it could be both — or neither.

What Is Working Capital?

At its core, working capital represents a company’s short-term financial health and operational liquidity — the ability to meet near-term obligations using assets that can be turned into cash.

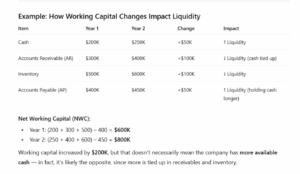

Formula:

Working Capital = Current Assets – Current Liabilities

Current Assets include:

• Cash

• Accounts Receivable (AR)

• Inventory

Current Liabilities include:

• Accounts Payable (AP)

• Accrued Expenses

• Short-term Debt

Positive vs. Negative Working Capital

• Positive Working Capital:

When current assets exceed current liabilities, meaning you have more short-term resources than obligations.

– Usually signals a strong liquidity position.

– But too much can mean cash is trapped in receivables or inventory that isn’t converting quickly.

• Negative Working Capital:

When current liabilities exceed current assets, meaning you’re effectively using supplier financing to fund operations.

– Can be efficient if growth and collections are predictable.

– But risky if demand slows — you may run short of cash quickly.

The Tradeoffs

Whether positive or negative working capital is beneficial depends entirely on your company’s business model, cash conversion cycle, and growth visibility.

If your company operates with negative working capital — collecting cash from customers before paying vendors — that’s fantastic if your forecasting is reliable. But without a solid understanding of future demand, it’s easy to overextend — spending cash today based on growth that may not materialize tomorrow.

Conversely, large positive working capital can create stability and predictability. However, depending on your working capital cycle, that cash could be trapped on your balance sheet, unavailable for reinvestment or growth.

Why Working Capital Management Matters

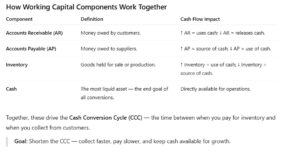

• Liquidity: The ability to meet short-term obligations.

• Efficiency: How well you manage the cash flow between AR, AP, and inventory.

• Flexibility: Access to working capital gives room for reinvestment and resilience.

• Risk: Chronic negative working capital can signal stress, but sometimes it’s just part of a business model (e.g., retail or subscription services).

The Financing Connection: Where Capvia Comes In

The key to managing working capital properly isn’t just operational discipline — it’s having the right debt facility for your specific situation.

The right structure can turn trapped balance sheet cash into accessible liquidity — funding growth, bridging seasonality, or stabilizing cash flow without overextending equity.

At Capvia, we help businesses structure the right financing tools around their working capital needs — aligning lenders, cash cycles, and growth objectives so capital works for you, not against you.

Final Thought

Working capital isn’t just a number — it’s the heartbeat of your business operations.

Whether it’s positive or negative doesn’t matter nearly as much as how you manage it and what financing structure supports it.

Capvia helps businesses build that bridge — turning working capital from a constraint into a catalyst for growth.